Alienation Clause

| Property law |

|---|

| Part of the common law series |

| Types |

| Acquisition |

|

| Estates in land |

|

| Conveyancing |

|

| Future use control |

| Nonpossessory interest |

| Related topics |

|

| Other common law areas |

|

In property law, alienation is the voluntary act of an owner of some property disposing of the property, while alienability, or being alienable, is the capacity for a piece of property or a property right to be sold or otherwise transferred from one party to another.[1][2][3][4] Most property is alienable, but some may be subject to restraints on alienation. In England under the feudal system, land was generally transferred by subinfeudation and alienation required licence from the overlord. Some objects are incapable of being regarded as property and are inalienable, such as people and body parts.[citation needed]Aboriginal title is one example of inalienability (save to the Crown) in common law jurisdictions. A similar concept is non-transferability, such as tickets. Rights commonly described as a licence or permit are generally only personal and are not assignable. However, they are alienable in the sense that they can generally be surrendered.

English common law traditionally protected freehold landowners from unsecured creditors. In 1732, the Parliament of Great Britain passed legislation entitled “The Act for the More Easy Recovery of Debts in His Majesty’s Plantations and Colonies in America”, which required all real property in British America to be treated as chattel for debt collection purposes. The legislation was reenacted by many statehouses after the American Revolution, leading to the more commodified and transferable development of American property law.[5]

See also[edit]

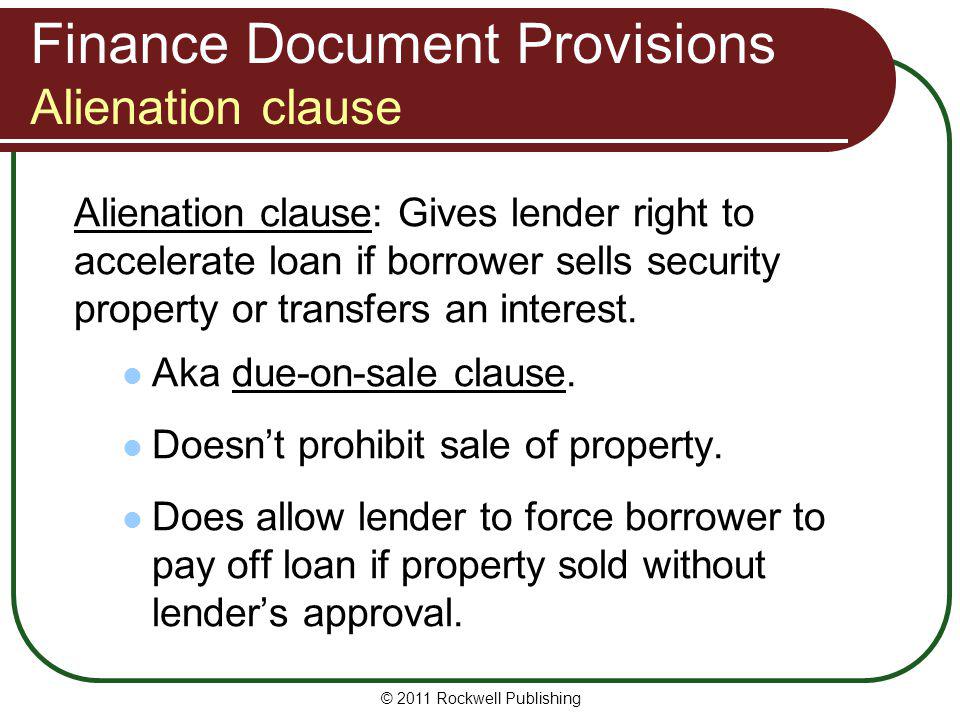

An alienation clause is language in a mortgage or trust deed that allows the lender to call the loan immediately due and payable in the event the owner sells the.

References[edit]

- ^Busby, John C (23 September 2009). 'Alienable'. LII / Legal Information Institute.

- ^'alienable - Definition of alienable in English by Oxford Dictionaries'. Oxford Dictionaries - English.

- ^'What is ALIENABLE? definition of ALIENABLE (Black's Law Dictionary)'. 4 November 2011.

- ^'What is ALIENATION? definition of ALIENATION (Black's Law Dictionary)'. 4 November 2011.

- ^Priest, Claire (2006). 'Creating an American Property Law: Alienability and Its Limits in American History'(PDF). Harvard Law Review. 120: 385. Retrieved 31 October 2017.

What Is an Acceleration Clause?

An acceleration clause is a contract provision that allows a lender to require a borrower to repay all of an outstanding loan if certain requirements are not met. An acceleration clause outlines the reasons that the lender can demand loan repayment and the repayment required.

It is also known as an 'acceleration covenant.'

Key Takeaways

- An acceleration clause or covenant is a contract provision that allows a lender to require a borrower to repay all of an outstanding loan if specific requirements are not met.

- The acceleration clause clearly outlines the reasons that the lender can demand loan repayment and the repayment required, such as maintaining a certain credit rating.

- An acceleration clause helps to protect lenders who extend financing to businesses in need of capital.

Acceleration Clause Explained

An acceleration clause allows the lender to require payment before the standard terms of the loan expire. Acceleration clauses are typically contingent on on-time payments.

Acceleration clauses are most common in mortgage loans and help to mitigate the risk of default for the lender. They are usually based on payment delinquencies but they can be structured for other occurrences as well. In most cases, an acceleration clause will require the borrower to immediately pay the full balance owed on the loan if terms have been breached. With full payment of the loan the borrower is relieved of any further interest payments and essentially pays off the loan early at the time the acceleration clause is invoked.

An acceleration clause is usually based on payment delinquency, however the number of delinquent payments can vary. Some acceleration clauses may invoke immediate payoff after one payment is missed while others may allow for two or three missed payments before demanding that the loan be paid in full. Selling or transferring the property to another party can also potentially be a factor associated with an acceleration clause.

There is enough new gameplay content and depth of replayability to satisfy warriors of all levels including special cross over characters such as Sophitia from the SOULCALIBUR series and battle stages from ATELIER, DYNASTY WARRIORS, NINJA GAIDEN Sigma 2 and SAMURAI WARRIORS. The next evolution of the OROCHI universe, WARRIORS OROCHI 3 Ultimate. Warriors orochi 3 ultimate nin. Welcome to Warriors Orochi 3 Ultimate, the enhanced version of the almost three year old Warriors Orochi 3, and welcome back to grinding the hell out of it. Some of you will probably remember that. The WARRIORS OROCHI series is a series of tactical action games in which heroes from the DYNASTY WARRIORS and SAMURAI WARRIORS franchises work together in an effort to defeat Orochi, the Serpent King. The latest title in the series, WARRIORS OROCHI 3, features over 120 playable characters, who can be played freely in three-character teams. Warriors Orochi 3 Ultimate (無双OROCHI2 アルティメット, Musou OROCHI 2 Ultimate) is a third re-release and sequel of Warriors Orochi 3 which continues from the original game's good ending. Akihiro Suzuki returns as the producer and Yōji Noda is the director. The new music in this title was composed. The Ultimate Musou Achievement in Warriors Orochi 3 Ultimate: Used a True Musou Burst - worth 10 Gamerscore. Find guides to this achievement here.

For example, assume a borrower with a five year mortgage loan fails to make a payment in the third year. The terms of the loan include an acceleration clause which states the borrower must repay the remaining balance if one payment is missed. The borrower would immediately be contacted by the lender to pay the remaining balance in full. If the borrower pays then they receive the title to the home and takes full ownership of the property. If the borrower cannot pay then they are considered in breach of contract and the lender can foreclose and seize the property for resale.

Invoking the Acceleration Clause

Acceleration clauses are most commonly found in mortgage and real estate loans. Since these loans tend to be so large, the clause helps protect the lender from the risk of borrower default. A lender may choose to include an acceleration clause to mitigate potential losses and have greater control over the real estate property tied to a mortgage loan. With an acceleration clause, a lender has greater ability to foreclose on the property and take possession of the home. This may be advantageous to the lender if the borrower defaults and the lender believes they can obtain value through a resale.

Retrieved July 7, 2016. .jpg) Alex Navarro (January 23, 2007). Eduardo Vasconcellos (January 26, 2007).

Alex Navarro (January 23, 2007). Eduardo Vasconcellos (January 26, 2007).